Should You Choose Dividend Stocks to Combat Inflation and Rate Hikes?

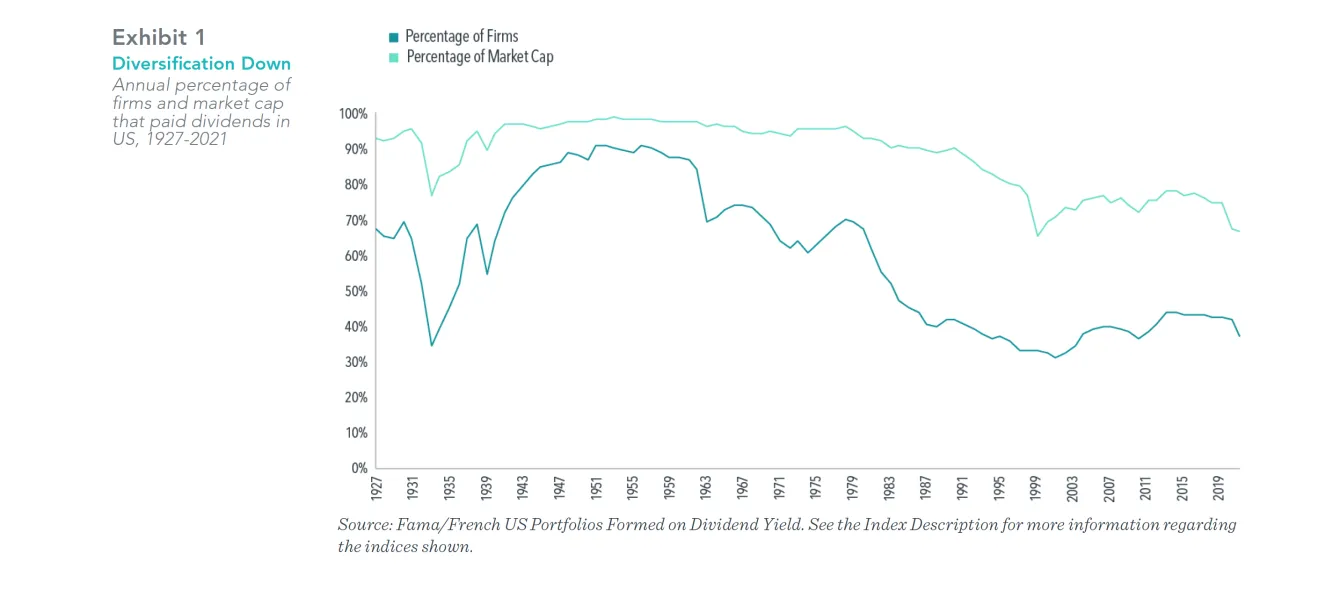

Inflation in the US has surged to the highest level in nearly 40 years, reaching 7.9% in February 2022.1,2 This, coupled with the US Federal Reserve’s decision to raise interest rates, has alarmed many investors.3 Some are turning to dividend-paying stocks, hoping to receive more income protection and higher returns.4 Will it work? Before diving into the performance of dividend-paying stocks, it’s important to note that the percentage of firms paying dividends has declined globally.5 As shown in Exhibit 1, 68% of US companies were paying dividends in 1927, while only 38% of firms paid in 2021. By focusing only on dividend-paying stocks, we will be sacrificing diversification. In addition, a dividend-focused strategy does not necessarily provide stable income. In fact, changes in dividend policy are common, especially during times of higher uncertainty. For example, many dividend payers cut their dividends during the pandemic—in the first three quarters of 2020, dividends from each dollar invested in US markets decreased by 22% compared to the same period in 2019.6

Do Dividends Help Combat High Inflation?

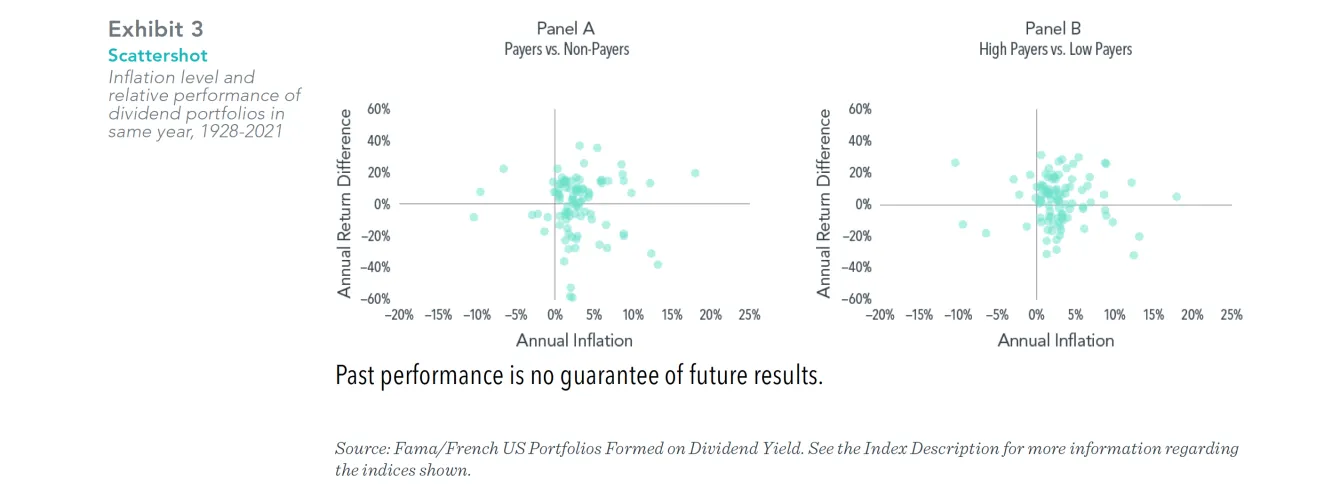

To answer this question, we study the performance of Fama/French US portfolios formed on dividend yield from 1928 to 2021.7 At the end of each June, all US companies are divided into two groups, payers and nonpayers, based on whether they paid a dividend during the previous 12 months. Then, within the payers, high payers are defined as the 30% of firms with the highest dividend yields, and the low payers are the bottom 30%. As of December 2021, the weighted average dividend yield is 1.8%, 0.7%, and 3.7% for payers, low payers, and high payers, respectively.

Exhibit 2 shows that all four dividend portfolios had positive nominal and real average returns in high-inflation years, when inflation was on average 5.5% per year.8,9 So outpacing high inflation over the long term is not a unique advantage of dividend-paying stocks. In addition, the return differences between payers vs. nonpayers and high payers vs. low payers are not reliably different from zero. Therefore, we don’t see strong evidence that dividend-paying stocks deliver superior inflation-adjusted performance during high inflation periods.

In Exhibit 3, we take a closer look at inflation and the relative performance of dividend-paying stocks each year. The scatterplot charts reveal no clear pattern between the level of inflation and the difference in performance between payers and nonpayers (Panel A) or between high payers and low payers (Panel B) in the same year. The lack of relation is also apparent when we look at the performance of dividend portfolios against contemporaneous changes in annual inflation in Exhibit 4. These results suggest that even a crystal ball on annual inflation levels or inflation changes tells us little about how dividend-paying stocks would fare. As a result, chasing dividends during, or in anticipation of, high inflation periods may be unlikely to lead to better investment outcomes.

What About Interest Rates?

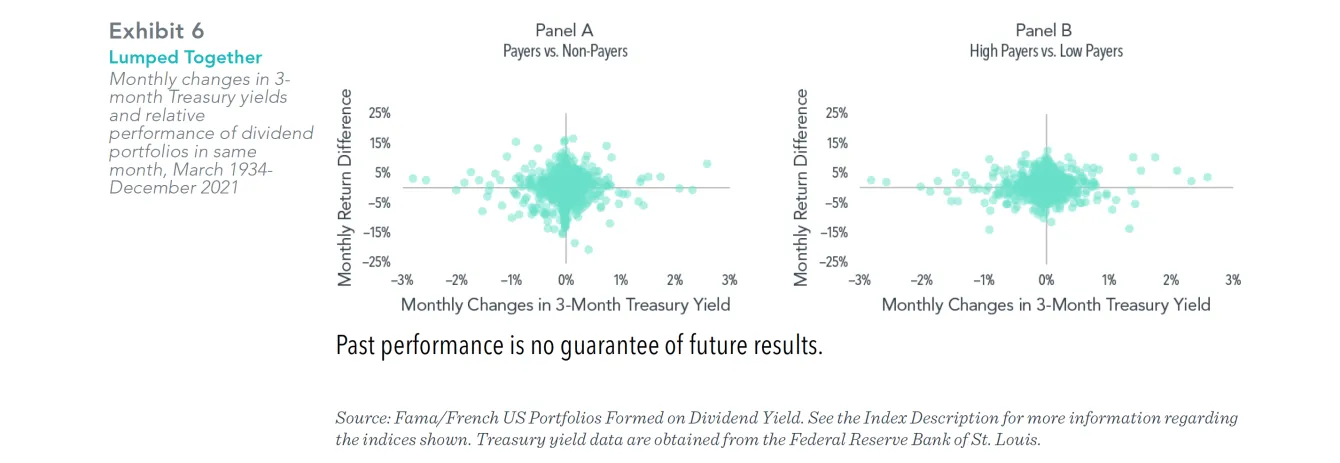

We first look at the average monthly returns for different dividend portfolios in months with rising 3-month Treasury yields. Exhibit 5 shows that dividend payers, nonpayers, high payers, and lower payers had similar average monthly returns from March 1934 to December 2021. The conclusions are similar using the effective federal funds rate and 10-Year Treasury yields.10 Piling into dividend stocks would not have led to superior returns in months with rising interest rates.

Changes in interest rates are largely unpredictable, even with Fed signals.11 Still, we ask what perfect foresight on interest rate changes each month can do for investors. The answer is not much. There is no discernible relationship between interest rate movements and the relative performance of dividend payers over nonpayers or high payers over low payers in the same month, as shown in Exhibit 6. Again, the results are similar when we use other interest rates, such as the effective federal funds rate and 10-Year Treasury yields.

What Should Investors Do?

It is natural to be concerned about the potential impact of high inflation and rising interest rates on portfolios. However, we believe our analysis shows there is no reason to expect dividend-paying stocks or high dividend payers to offer more protection and higher returns during these periods. Market prices reflect the aggregate expectations of all market participants, including expectations about inflation and interest rates. Staying disciplined and broadly diversified, instead of chasing dividend stocks, may put investors in a better position to achieve their investment goals.

Wealth of knowledge at your fingertips.

We make our whole team of Extraco Wealth & Trust experts available to you.

Meet with an Advisor Today!

Information provided by Dimensional Fund Advisors

Fama/French Portfolios Formed on Dividend YieldProvided by Fama/French from CRSP and COMPUSTAT data. Includes all NYSE, AMEX, and NASDAQ stocks for which we have market equity for June of year t, and at least 7 monthly returns (to compute the dividend yield) from July of t-1 to June of t. Portfolios are formed on D/P at the end of each June using NYSE breakpoints. The dividend yield used to form portfolios in June of year t is the total dividends paid from July of t-1 to June of t per dollar of equity in June of t.

Indices are not available for direct investment. Returns are in USD.

1. “Consumer Price Index - February 2022," Bureau of Labor Statistics, US Department of Labor, March 10, 2022.

2. US inflation is measured as the annual rate of change in the Consumer Price Index for All Urban Consumers (CPI-U, not seasonally adjusted) from the Bureau of Labor Statistics.

3. Nick Timiraos, “Fed Raises Interest Rates for First Time Since 2018,” Wall Street Journal, March 17, 2022.

4. Hardika Singh and Michael Wursthorn, “Investors Gobble Up Dividend Stocks During Market Turbulence,” Wall Street Journal, February 8, 2022.

5. Stanley Black, “Global Dividend-Paying Stocks: A Recent History” (white paper, Dimensional Fund Advisors, March 2013).

6. “Dividends in the Time of COVID-19,” Insights (blog), Dimensional Fund Advisors, November 30, 2020.

7. See the Index Description for more information regarding Fama/French Portfolios formed on Dividend Yield.

8. High-inflation years are defined as having inflation greater than the full sample median, 2.68%, from 1928 to 2021.

9. Real returns are calculated using the following method: [(1 + nominal annual return) / (1 + inflation rate)] – 1.

10. “Federal Funds Effective Rate (FEDFUNDS),” Federal Reserve Bank of St. Louis (Percent, Monthly, Not Seasonally Adjusted).

11. Sooyeon Mirda, “Reading Fed Tea Leaves? Watch Market Prices Instead,” Insights (blog), Dimensional Fund Advisors, September 24, 2022.

This material is in relation to the US market and contains analysis specific to the US. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorised reproduction or transmitting of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd, Dimensional Japan Ltd. and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services. Risks Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful. UNITED STATES Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.